Contents

On a chart, the ADX line is accompanied by two separate directional indicators – the positive directional indicator (+DI) and the negative directional indicator (–DI). Before looking at some signals with examples, keep in mind that Wilder was a commodity and currency trader. The examples in his books are based on these instruments, not stocks. This does not mean his indicators cannot be used with stocks, however. Some stocks have price characteristics similar to commodities, which tend to be more volatile with short and strong trends. Stocks with low volatility may not generate signals based on Wilder’s parameters.

This will trigger an open order and since the ADX is trending, you will avoid getting into a whipsaw situation. If you are into biotech penny stocks that fly up and down, 75 to 100 occurrences could be your sweet spot. I do not want to give you the impression I am flip-flopping, I just want to be clear the numbers detailed in this article work for me, but are not absolute rules. I, however, like to trade in the center, where there is volatility, but not so much that analysis of any form plays second fiddle to market hysteria. This of course is completely your call on what ADX reading will trigger you to trade.

We will be following the order mentioned in the above list and buckle up your seat belts to follow every upcoming coding part. Create your Forex Guy account to get access to all the goodies. That is the point of the article Dave… showing that you don’t need the ADX on the chart. So in a nutshell, this is one indicator upon another EMA upon another indicator upon another EMA… you get the point. Let’s have a look at a short trade example using the 20 trigger line.

Average Directional Index – How to Use the ADX in Trading

From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here. When you apply this combination, you can place a stop-loss at the last high of the ADX indicator. The divergence signals generated by the ADX are very similar to those from oscillators like the MACD or the RSI.

The Directional Movement Index and the Average True Range indicators are interconnected with a few other bits and pieces to make up the ‘ADX system’; it’s almost like a Frankenstein Indicator. The Average Directional Index crossed the 20 trigger level and signals a buy trade. The market eventually pushed upwards in line with the signal. Today we cut open the Average Directional Index, a well known tool in the indicator trading community.

The average true range is a market volatility indicator used in technical analysis. The default Average Directional Index helps traders determine the strength of a trend, not its actual direction. The Clean ADX helps traders determine the strength of a trend on a longer time, and the possible direction on different timeframes. The bidirectional Breakout Volume determines both directions of breakout or breakdown volume.

DOES ADX HAVE ANY IDEAL TIMEFRAME?

A wrong combination can also lead to laying more emphasis on a single price element while overlooking other crucial cues. In the above case, a trader could land up focusing on trend momentum while overlooking other important elements such as volatility. Now, let’s compare our returns with SPY ETF (an ETF designed to track the S&P 500 stock market index) returns. The ADX is meant to be a trend strength indicator; unfortunately it’s often late to the party. Above is a visual representation on how traders generally relate the Average Directional Index values to the market.

- Based on the ADX indicator trading rules, a reading above 25 is signalling a strong trend and the likelihood of a trend developing.

- In order to determine the stop-loss location for the best ADX strategy, first identify the point where the ADX made the last high prior to our entry.

- This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

- Crossovers can occur frequently, sometimes too frequently, resulting in confusion and potentially lost money on trades that quickly go the other way.

The list of calculations above might have scared you a bit, but don’t worry – when you trade, all of this will be automated. Yet, it is always good to be familiar with the formula that generates the tool you rely on to earn profits. The Average Directional Index was developed by one of the most famous technicians of the 20th century – J. The ADX line is usually plotted in white, while the +DI and DI lines are green and red.

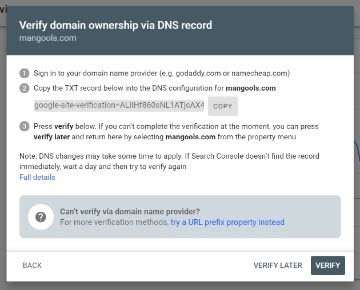

Data collection notice

Typically, an ADX value of 25 is used as the threshold for a strong trend — if the ADX is above 25 it indicates a strong trend. On the flip side, low and falling levels of the ADX and ADXR indicate a trendless market. This article explains the DMI and at the end, we do a backtest to find out if you can use the DMI to make a trading strategy. This step is optional but it is highly recommended as we can get an idea of how well our trading strategy performs against a benchmark .

You should first wait for the indicator to show a reading higher than 25 before seeing whether the market is going up or down. If the ADX line crosses higher than 25 and +DI is above –DI, an uptrend is present in the market. Look at your most recent trades and see how exiting with the Parabolic SAR compares with exiting based on DM line crosses. Well, what would happen if we combined the Parabolic SAR (Stop-and-Reversal) as a way for exiting trades.

Let’s see what are the best ADX trading rules and how to use ADX indicator. Also, read the hidden secrets of moving average, for more information. Any ADX peak above 25 is considered strong, even if it is a lower peak. In an uptrend, the price can still rise as the ADX moves lower as overhead supply decreases as the trend progresses . The ADX amount between 20 and 40 shows us the confirmation of a trend.

For example, the first group of whipsaws in September 2009 occurred during a consolidation. Moreover, this consolidation looked like a flag, which is a bullish consolidation that forms after an advance. It would have been prudent to ignore bearish https://forex-trend.net/s with a bullish continuation pattern taking shape.

A moving average is a technical analysis indicator that helps level price action by filtering out the noise from random price fluctuations. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies. Before we even look to see if the market goes up or down, we must first wait for the ADX indicator to show a reading above 25. Based on the ADX indicator trading rules, a reading above 25 is signalling a strong trend and the likelihood of a trend developing.

When the ADX falls below 25 it suggests that there is no strength in the trend and most likely we’re consolidating. This means we can look for potential intraday breakout signals. First, we’ll focus on how to use ADX indicator for intraday trading. The privacy and protection of your data and information provided to us is of vital importance. Sharekhan Comtrade Private Limited shall ensure to safeguard the security and confidentiality of any information you share with us. Any personally identifiable information of the customers obtained by us shall not be used or shared other than for the purposes to which the customers consents.

CCI Indicator — What is it? (Trading Strategy And Backtest)

It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs , Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. We now understand that crossovers of the +DI and -DI trigger buy or sell signals.

In order to gauge the direction of the trend, we also need to look at the actual price action. Going forward, keep in mind that the ADX indicator doesn’t give you any information about the direction of the market. It just provides you with information about the strength of a trend. With a standard range of 14 bars, ADX offers a “bigger picture” than many other technical indicators. Before moving forward, we must define which technical indicator we need for the best ADX strategy.

A Must-ReadeBook for Traders

It is also important to understand that stock prices are not likely to move in a specific direction in the short term. But when it comes to long-term pricing patterns, you will likely recognize a clear market trend. You will primarily observe three types of trends in the market. Trading against a powerful trend lowers risk and boosts possible profits. Whenever the stock price is substantially trending, the ADX is utilized to identify this. Indicator redundancy is when multiple indicators are used to measure similar price elements – for instance, using the ADX to gauge trend momentum and using Stochastics for the same purpose.

The final pairing shows an inside https://topforexnews.org/, which amounts to no directional movement . Both Plus Directional Movement (+DM) and Minus Directional Movement (-DM) are negative and revert to zero, so they cancel each other out. Wilder’s DMI consists of three indicators that measure a trend’s strength and direction. The ADX identifies a strong trend when the ADX is over 25 and a weak trend when the ADX is below 20. Crossovers of the -DI and +DI lines can be used to generate trade signals. For example, if the +DI line crosses above the -DI line and the ADX is above 20, or ideally above 25, then that is a potential signal to buy.

If this happens when the https://en.forexbrokerslist.site/ is below 25, it is a solid signal to place sell orders. Crossovers are as much a trigger of trade entry as they are for trade management and exits. The above calculation will plot the three lines of the ADX indicator. The +DI will be the positive directional indicator, whereas the –DI will be the negative directional indicator. The ADX is a non-directional indicator (essentially the average difference between +DI and –DI) and is plotted from 0 to 100, with no negative values.